- To create a more efficient and agile Australian payments group to deliver new payments innovations faster for the benefit of users and consumers

- Enhanced competition with global payments companies

- More even representation of users of the Australian payment system

- More engagement with small businesses through a special purpose advisory committee reporting directly to the board

- Open and non-discriminatory access to the Australia’s three payments schemes is maintained

Shareholders and members of Australia’s three domestic payment organisations, BPAY Group, eftpos and New Payments Platform Australia (NPPA), have submitted a formal application to the Australian Competition and Consumer Commission (ACCC) seeking to amalgamate the three schemes under a single parent company and Board.

eftpos, BPAY and NPP will continue as separate schemes and distinct brands. There will be no lessening of competition as the three schemes’ core payment products do not compete with each other in any meaningful way today. The amalgamation of Australia’s three payment schemes under a single company is expected to improve competition, including with the international card schemes who currently dominate retail transactions in Australia.

The owners of Australia’s three payment organisations are seeking to foster coordination and alignment between the three organisations to bring more payments innovations to market more quickly. A unified entity will see the three schemes work together and collaborate on new products such as QR codes and hybrid products.

Reducing duplication and fragmentation will see users of Australia’s payments system have access to payment innovations in a more timely and efficient way.

Committee Chair Robert Milliner said the applicants will continue to engage with the regulator and payments stakeholders throughout the ACCC’s merger authorisation process:

“We look forward to working constructively with the ACCC throughout this process as we explain the benefits of creating a domestic payments player that’s better able to compete with multinational schemes.”

“For example, the Industry Committee process established to consider the potential amalgamation resulted in agreement to accelerate the roll out of eftpos online, should the ACCC authorise the amalgamation, giving merchants access to lower cost payment options online. Being able to continue this alignment will support more efficient and successful rollout of future payment innovations.”

Milliner said the collaborative process used to agree the amalgamation had already resulted in guaranteed rollouts of new products not possible under the status quo and demonstrated the effectiveness of this approach.

An independent report authored by payments industry expert, Lance Blockley, submitted as part of the application to the ACCC states that the lack of coordination between the domestic payment schemes in the deployment of new technologies and services is slowing down the rate of innovation:

“There is a need for the presently fragmented domestic payments entities to combine, in order to provide a larger, stronger and more robust domestic player that would have the resources and coordinated approach necessary to keep pace with the innovations in products and services being deployed by the growing array of much larger international competitors.”

Blockley also says a potential benefit of amalgamation is the enhanced competitive positioning of Australian payment products and services against the international players:

“A viable domestic payments entity can be operated to provide efficient, low cost retail payments services to the benefit of Australian users: consumers, merchants and businesses.”

The application makes clear that each of the three schemes and brands will be preserved, meaning there is no change to payment options like eftpos, Beem It, BPAY, Osko and PayID.

BPAY CEO John Banfield said coordination between the three schemes would foster more effective rollouts of payment innovations:

“Improved coordination would likely improve sequencing of investments and prioritisation of innovations for the banks and other financial institutions and ADIs, to rollout faster services for all customers.”

eftpos CEO Stephen Benton said the amalgamation will preserve and strengthen eftpos:

“eftpos is highly innovative, agile and competitive today, however understands that greater scale and cooperation may create a more sustainable ability to collectively compete.”

NPPA CEO Adrian Lovney said a single board will be more agile and respond to the changing payments landscape:

“The proposed new entity will see faster deployment of capability not currently possible across three separate organisations. Through a single Board and aligned objectives we can get to work on rolling out new solutions that Australian consumers and businesses want to see. This new entity will be better able to respond to current and emerging trends. This is particularly relevant in the long-term, as payments increasingly move beyond plastic cards towards more digital forms of payment.”

Small business and smaller payment users will be better represented under the new structure, by the formation of two Advisory Committees for scheme members and end-users that will each be chaired by an independent Director of the NewCo Board.

It is expected that the application will be made publicly available by the ACCC via their website in the next day or so and is subject to a period of broad consultation. Throughout this time, the applicants will continue to have open dialogue and engagement with users of the payments system to explain the outcomes and benefits of the proposed merger.

Notes

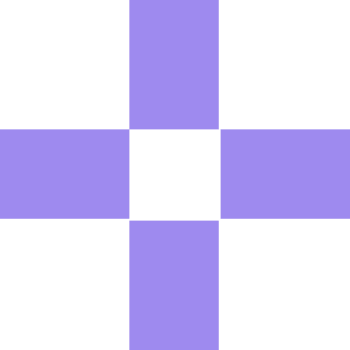

- A diagram explaining the new structure is on the next page

- Attached is a summary of the ACCC application, the full version will be published on the ACCC website at a later date